Meet Warren

A conversational AI designed specifically for Private Equity and Investment Bankers. Get instant access to real-time financial data, M&A activity, and company performance insights—all through simple, natural language. Save time, make smarter decisions, and streamline workflows with personalized information and proactive insights. Warren helps financial and industry leaders stay ahead, from evaluating deals, managing portfolios, or advising clients.

Overview

As the Principal Product Designer, I led the design and development of Warren, a conversational AI platform tailored for Private Equity (PE) firms and Investment Bankers.

Warren, a conversational AI for Private Equity and Investment Bankers, will make it easy to access financial data quickly using simple questions. This will solve problems like slow deal evaluations for Private Equity and long data-gathering times for Investment Bankers, helping both work more efficiently with real-time insights.

Problem Context

Private Equity professionals and Investment Bankers face delays in accessing and analyzing critical financial data. Private Equity (Buy-Side) teams struggle with data spread across multiple tools, making deal evaluation slow. They need quick, relevant insights to make faster investment decisions.

Investment Bankers (Sell-Side) face time-consuming data collection for client presentations. They need rapid access to deal and market information to support quick decision-making.

Both groups need a faster, more efficient way to get real-time financial insights to improve their workflow and outcomes.

Constraints

Limited Resources:

Balancing the development of both desktop and mobile features with a small team.

AI Hallucinations:

Ensuring Warren provides accurate, relevant financial data without errors.

Data Integration:

Pulling data from multiple sources while maintaining accuracy across platforms.

Mobile Complexity:

Simplifying complex financial data for mobile screens while ensuring usability.

Legacy integration:

Current platform was might not be flexible to support the demands of modern AI-driven tasks.

Goal

To modernize financial workflows by providing instant access to trusted, real-time data through Warren. Using conversational AI, users can easily access critical insights via natural language, enabling faster, more informed decisions. This shift from manual tasks to intelligent automation keeps professionals ahead in a fast-paced environment.

Team & Structure

My Role & Responsibilities:

Design Strategy

User Research

UX Lead

Visual Design

Teammates:

Product Manager

3 ML Engineers

1 Software Engineer

3 SMEs

Timeline:

• 6 Months launch MVP

Design Process

Research & Discovery:

• Understand our users

• Competitive analysis

• Reference data

• Prioritize with PM

Concept & User Test:

• Design Strategy

• Explore solutions

• Three concepts options

• User test and validate

Dev Handoff:

• Finalize visualize design

• Scope with PM and Devs

• Prep for development

• Provide design support

Research & Discover

Narrowing Down Users Through Surveys and then User Interviews:

Focused on Private Equity (Buy-Side) and Investment Bankers (Sell-Side).

These groups have unique needs that benefit most from conversational AI.

Studied their workflows, decision-making processes, and pain points related to accessing and analyzing financial data.

Key Insights

10-20%

Potential deals lost due to delays in data gathering and decision-making for Private Equity firms

70%

Investment bankers say that inaccurate data can cost them business opportunities

50%

Finance professionals are using AI for real-time, accurate data to reduce errors and speed up workflows.

Our Users

Silvio -

Analyst, Investment Banker

When I’m on the way to a client meeting, I don’t have time to sift through data. I need market updates and deal information in real-time, so I can go in prepared.

Yuri -

Investment Banking (M&A)

When working on deals, timing is everything. I need a mobile app to track market shifts and M&A activity in real-time, so I can adjust strategies and respond to client needs, even when I’m away from my desk

Rhina -

Associate, Private Equity

I need financial metrics like EBITDA instantly. Having to manually calculate or search for this slows down my due diligence process, and we could miss good opportunities.

Cillian -

Analyst, Private Equity

It takes forever to switch between tools to get the data I need. I’m wasting time piecing together information from multiple sources when I should be focusing on evaluating deals.

Understanding Our AI

Storyboarding Method

“I used a storyboard to show how users interact with the AI in real situations. It helped me ensure the conversation feels natural, engaging, and user-friendly.”

Top considerations based on user research:

Personality and Tone:

Balancing professionalism with approachability in the AI’s tone.Error Handling:

Designing a smooth experience when the AI doesn’t understand or makes mistakes.Contextual Awareness:

Making the AI remember context and flow naturally in conversations.

Design Strategy

The storyboard guided this strategy which informed the design of Warren to meet the specific needs of these financial professionals, improving their workflow and decision-making efficiency:

Simplify data access:

Warren would provide fast, high-level financial summaries with deeper options for analysis.Prioritize mobile access:

Focus on real-time updates and quick insights for investment bankers on the go.Deliver contextual insights:

Use AI to offer relevant insights that help both Private Equity and Investment Bankers make quicker, informed decisions.

How might we’s:

What might we do to ensure the AI understands complex financial queries?

What might we do to balance simplicity with detailed insights?

What might we do to create a professional yet approachable tone for the AI?

What might we do to keep user trust by ensuring data accuracy?

What might we do to handle AI errors without disrupting the user experience?

What might we do to make the AI remember context during conversations?

Ideation

I brainstormed features that would solve users' specific pain points:

Natural Language Query:

A conversational AI that responds to queries like “What’s the EBITDA of Company A for the last 5 years?” without needing users to sift through multiple tools.Real-Time Alerts:

Mobile notifications for market shifts or deal changes, particularly for M&A bankers who are frequently away from their desks.

Prototyping & Testing

Test Interaction Style:

Concept 1: Formal & Professional

Concept 2: Friendly & Conversational

Test User Interface:

Concept 1: Text-Heavy Interface

Concept 2: Visual-Heavy Interface

Concept 1: Formal & Professional

Concept 2: Friendly & Conversational

User Feedback

Overall Concept 2 was well received

Key Findings:

Conversational Approach:

Concept 2 was well-liked for its natural, friendly tone, making the AI feel approachable and easy to use.

Visuals for Quick Insights:

Users appreciated the visual charts and graphs, which made it faster and easier to scan and understand data.

Challenges with Broad Queries:

Users found that broad questions sometimes led to incorrect answers from the AI, which didn’t always match their intent.

Need for Answer Verification:

Users wanted a way to verify the AI's answers by seeing the data sources to ensure accuracy for reporting.

Establishing Trust:

Transparency was key. Users suggested adding a “Verify Data” button to check the source of the information and directly export verified data to reports.

Conclusion:

Concept 2 was well-received for its friendly tone and visual design, which made data easy to understand. However, broad questions sometimes led to incorrect answers, and users wanted more control over verifying the AI's responses.

Next Steps:

Add a "Verify Data" button to cite sources, giving users confidence in the accuracy of information.

Allow users to export verified data and visuals directly to reports.

Improve Warren’s ability to ask clarifying questions when queries are too broad, ensuring more accurate responses.

Test with visual designs

Visualize Design

The visual design for Warren was inspired by a unique blend of three characters and our parent company’s branding colors. Which consisted of red, black and white.

The financial wisdom and calm confidence of Warren Buffett.

The trustworthy and supportive demeanor of Alfred from Batman.

Allan Turing's analytical intelligence

AI Experience

This combination creates an AI that feels both highly competent and approachable. Warren’s interface is sleek and data-driven, like Turing’s analytical precision, while maintaining a conversational and reliable tone, similar to Alfred’s trusted butler role. The integration of Buffett’s personality adds a layer of financial insight and confidence, making Warren feel like a dependable, insightful assistant for financial professionals.

Key Features:

Conversational Interface: Users can type or speak their queries, and the AI provides instant access to financial data, analytics, or insights.

Real-Time Data: The app pulls real-time financial data, allowing users to react quickly to market changes.

Customized Dashboards: Users can create personalized views of their most important data points and reports, which the app updates automatically.

AI-Driven Insights: The AI proactively offers insights based on user preferences, such as market trends, stock movements, or industry developments.

Collaboration Tools: Users can share reports or data with their team via the app, enabling real-time collaboration across devices.

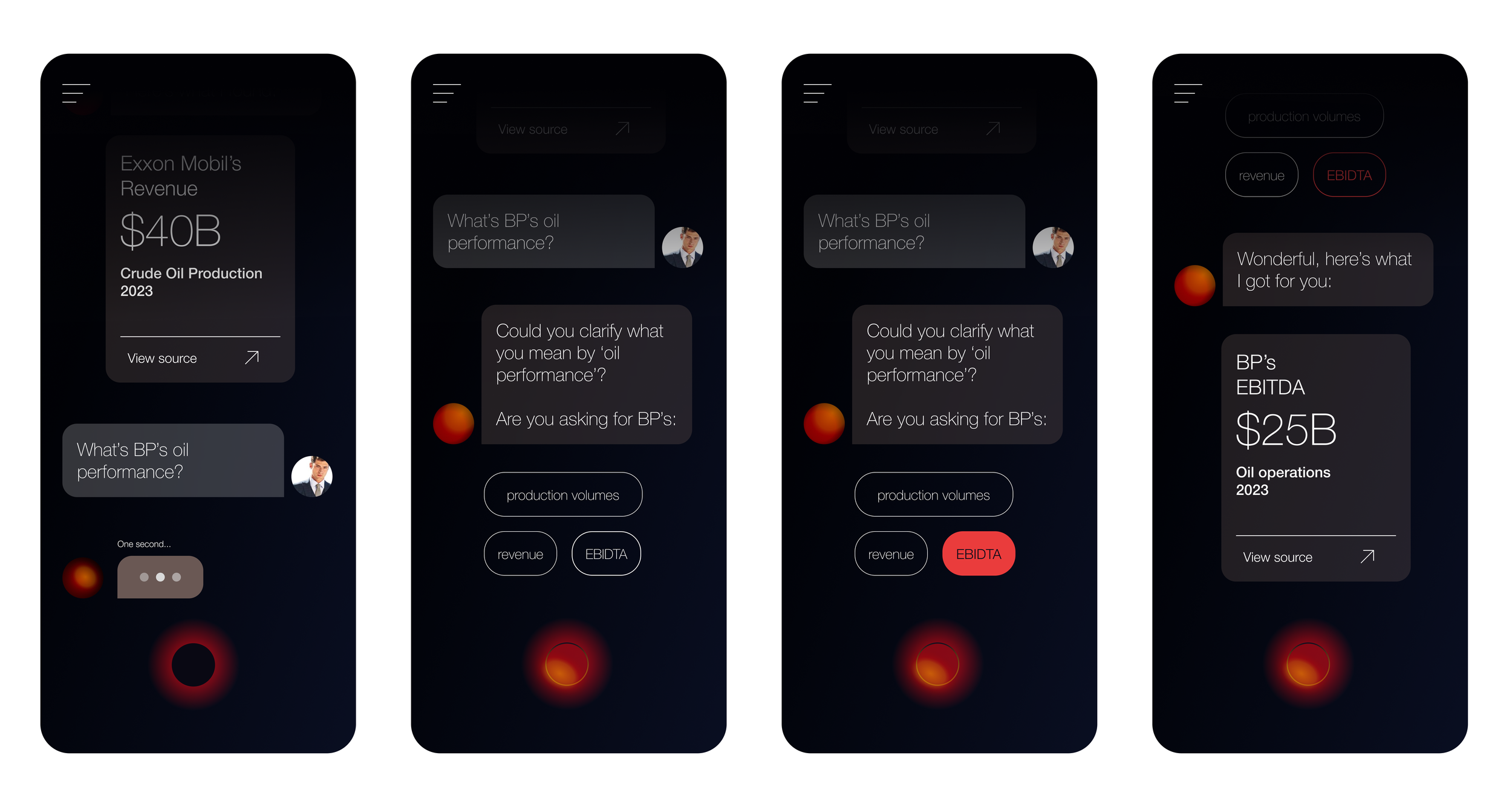

Warren’s conversational and helpful tone

Stats and charts for quick scanning

How Warren asks for clarification if questions are too broad.

Verifying Source to establish trust with users

Impact & Results

We used a batch-release method to roll out Warren. Initially, Warren was released to 25% of our users, allowing us to gather insights, learn, and iterate based on their feedback. We then incrementally increased access by 5% with each cycle, continuing this process until we reached a broader user base while improving the product with each iteration.

Key results included:

Increased Efficiency: Users reported a 40% reduction in time spent manually searching for data, thanks to the conversational interface.

Better Decision-Making: Real-time data access led to faster, more informed decisions, particularly in fast-paced sectors like M&A and portfolio management.

Positive User Feedback: The app received high praise for its usability, with users appreciating the natural language processing and intuitive data visualizations.

This iterative approach ensured continuous learning and improvements, resulting in a highly effective product for financial professionals.

Learnings

Iterative Design: Releasing in small batches helped us learn, adjust, and improve quickly. Iterative design is essential to gather insights and optimize user experience before scaling up.

Clarification & Error Handling: Users often ask broad questions. The AI needs to ask clarifying questions to avoid incorrect answers. Prioritize clear communication to guide users effectively.

Trust and Data Verification: Users want to verify the AI’s answers, especially when using them in reports or decisions. Always provide ways for users to confirm the accuracy of the data.

Design Principles:

Simplicity: Keep interactions simple and direct.

User Control: Let users guide the conversation rather than predicting their next step.

Visual Data: Charts and graphs are crucial for quickly understanding complex information.

Storyboarding: Storyboarding the user journey helped us refine the conversational flow, anticipate pain points, and ensure the AI felt intuitive and engaging.

Empathy for Users: Understanding the context of user needs (e.g., fast-paced M&A deals) ensures the AI fits their workflow. Empathy is key in designing AI that genuinely solves user problems.

Prototype

Check out the prototype here