Thurston App

Thurston leads a revolution in personal investing, offering a seamless and empowering experience crafted for the modern investor. Specifically designed to cater to millennials and novice investors, Thurston provides a refreshing approach to navigating the complexities of finance, instilling confidence as users navigate the previously unknown terrain of investing.

Overview

Thurston revolutionizes personal investing by providing a seamless, user-friendly experience for millennials and novice investors. Designed to build trust and offer financial education, Thurston simplifies complex financial products and empowers users to confidently navigate investing.

Problem Context

Traditional financial platforms like E*trade struggle to engage and retain millennials due to perceived complexity, lack of trust, and overwhelming jargon.

Data showed high inactivity rates and low conversion among millennial users, suggesting a need for modernization without alienating existing customers.

Feedback from the marketing survey:

“Feels like you already have to know finance in order to start using your website.”

— Antonio M., New customer, inactive five months after opening an account

“I preferred the Robinhood app… it’s pretty straightforward when I started investing and uncomplicated right from the start.”

— Alex G., Signed up with a competitor

Constraints

Established financial institutions face resistance to change from long-time customers who are accustomed to the current platform experience and may threaten to leave in response to significant disruptions.

Aging and singular code base present challenges in implementing site-wide changes, compromising overall system stability during modernization efforts.

The lack of new and modern stock offerings, such as cryptocurrency, limits the original platform's appeal and relevance to a segment of investors interested in digital assets.

We were unclear in terms of why new-generation investors were not encouraged to invest early since they are missing out on the benefit from long-term gains.

Goals

Without disrupting the current platform and current loyal customers who hate change:

Improve brand perception to appeal to modern audiences

Encourage the new generation of investors and increase conversion rates among millennials

Maintain loyalty of existing customers without disrupting their current workflows

Team & Structure

My Role & Responsibilities:

Design Strategy

User Research

UX/UI Lead

Visual Design

Teammates:

Product Manager

3 Engineers

Timeline:

• 6 Months launch MVP

6 Month Process

Research & Discovery:

• Understand our users

• Competitive analysis

• Reference data

• Prioritize with PM

Concept & User Test:

• Design Strategy

• Explore solutions

• Three concepts options

• User test and validate

Dev Handoff:

• Finalize visualize design

• Scope with PM and Devs

• Prep for development

• Provide design support

About Our Users

I designed high-level persona cards from customer interviews I’ve conducted and merged them with helpful data in the form of stats from our marketing research team to focus on key items about our users.

This method helped us understand our target users, their pain points, and what they value.

Millennials are aware of saving, but hesitate to invest due to a lack of knowledge, trust issues with hidden fees, and saddled with larger financial priorities.

Key takeaways from this research:

Very tech savvy and comfortable managing financial matters like banking on their mobile phone.

Millennials are open to financial advice services.

Rising costs of debt and job insecurity make it harder for millennials to save and invest.

A lack of knowledge and being overwhelmed by financial jargon about investing leads many millennials to delay investing.

Surprises:

• They do care about the future, where they would like to save for a house, a car, and emergencies.

Competitive analysis

Robinhood: Offers free trading with a simple interface, but lacks some advanced features.

Acorns: Known for automated investing and educational content, but has higher fees.

Stash: Allows fractional share investing and themed portfolios, but charges a monthly fee.

Wealthfront: Provides automated investing with tax efficiency, but limited human interaction.

Betterment: Offers automated portfolio management and goal-based investing, but higher fees for premium services.

Problem Prioritization

After the research synthesis, the Product manager and I narrowed down key problems that we felt were important to focus on, because there were numerous pain points and problems.

We focused on the following, “how might we solve for…”

• Build Trust: How might we solve for trust? Would a financial advisor help?

• Affordability: For not enough money to invest, can we offer a product that accommodates small investments?

• Easy education: How should we ease their anxieties when it comes to learning?

• User-friendly design: help with education, guides step-by-step transactions and simplified options can ease anxiety.

Design Strategy

I identified the key barriers to entry for millennial investors:

Confusing user interfaces.

Lack of trust in financial products.

Difficulty understanding investment terminology and processes.

My design focused on:

Simplifying onboarding:

We created an intuitive onboarding process to help users easily set up accounts.Educational components:

Introduced interactive tools and content to help users learn investment basics in a clear and digestible way.Personalized experiences:

Users could track investments based on their risk tolerance, goals, and timelines, allowing them to build confidence in their decisions.

Concepts & User Feedback

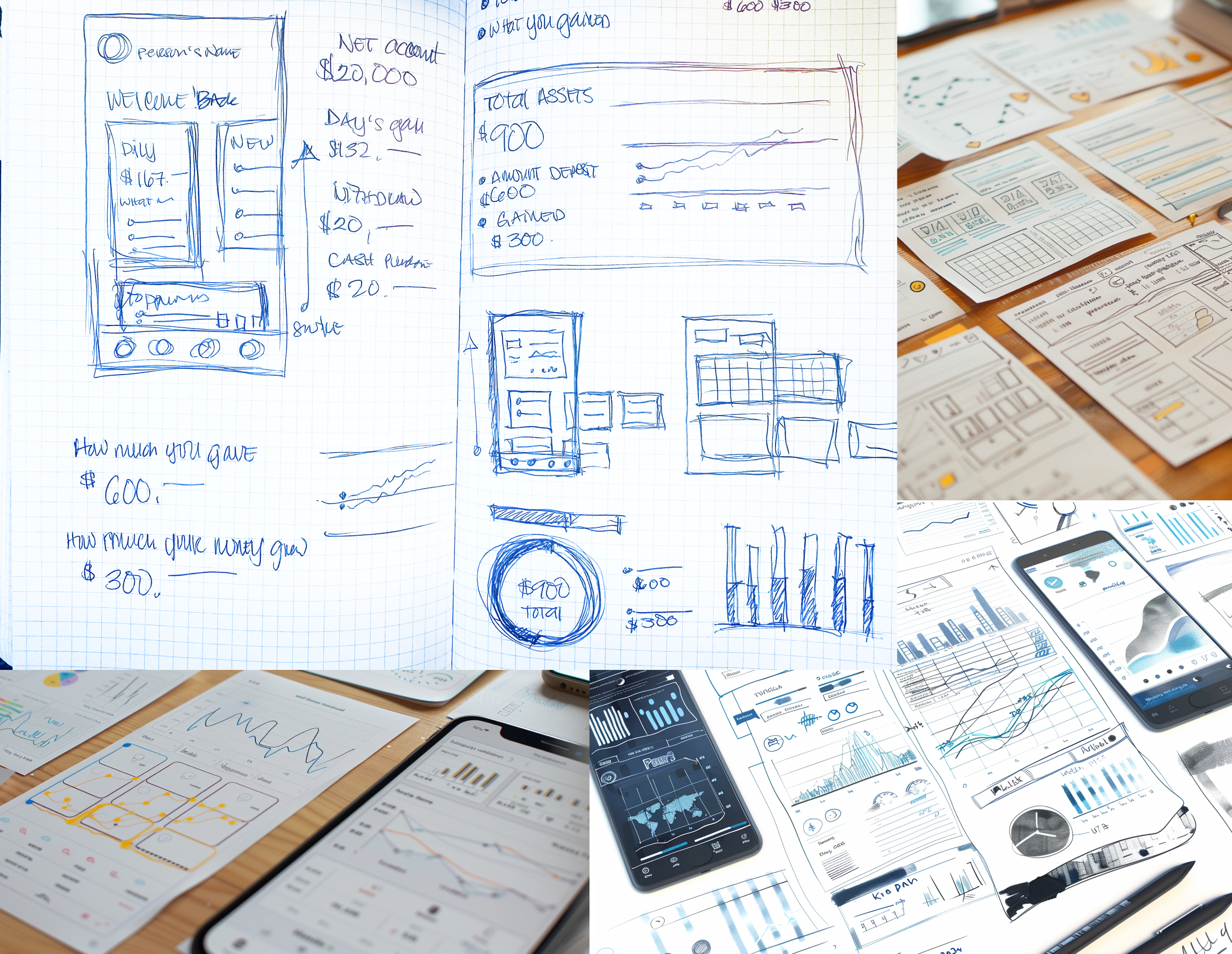

Ideation through sketches helped me understand the constraints of limited space on mobile. As I kept sketching, it was clear to keep the UI simple and prioritize key information users need to know right away.

Next, we tested three concepts in the form of wireframes in two weeks with 15 users.

Concept 1: Robo Advisor (Moderately Favored)

Users liked the personalized portfolio recommendations but wanted more control over individual stock selections. Half found it easy to follow and educational.

User Feedback: Half of the users initially favored this feature due to its simplicity and walking them through different investing styles. The biggest education for them was i.e. “When will you need the money” which provided them with perspective on how should they manage their money. The other half expressed a preference for a method to select individual stocks to independently build a portfolio based on their preferred investment style. While half did like the ease and comfort of having the robo advisor setting a portfolio for them and not worry.

Concept 2: Guided and stocks (Less Enthusiastic)

This concept provided step-by-step guidance but was met with mixed reactions. Some liked its simplicity, but others found certain data points confusing.

User Feedback: This concept received lukewarm enthusiasm. Half of the users appreciated the friendly content, finding it less intimidating and avoiding complex financial terms. They liked that it catered to their interests as a starting point. There were data points that were still confusing like the percentages of days gain as affected by the market, which gave them doubts.

Concept 3: Calculator then stocks (Most Preferred)

The most successful concept allowed users to input their starting amount and receive tailored investment advice. It appealed to users across the board, offering affordability and building confidence in their investment decisions.

User Feedback: A resounding success, as this experience caters to everyone, from those who distrust big banks due to the small cost to individuals with debt priorities and those needing guidance. The affordability and user experience provided them with a starting point to build familiarity and confidence. But what the users responded to most, was the ability to enter how much they would start with and preview what that amount could look like over time.

Validation

We validated the solution through user testing and collaborated with the marketing team to assess Product Market Fit. The feedback confirmed high interest and demand among target users. However, due to resource constraints, the final product was not built.

Finalize Visualize Design

Creating a different branding for Thurston was a good idea to specifically target millennials without disrupting existing ETrade customers. This approach allowed for tailored messaging, a new codebase, and a modern appeal offering flexibility for innovation.

Final Design

Intuitive interface with smarter search, streamlined choices, and transparent guidance, informed by the best of the three concepts and feedback from our user testing sessions.

Selected screens:

New customer onboarding

New investor experience where users can choose to opt into robo account set up or ‘skip’ and start using the calculator experience.

Returning customers building their wealth over time

Transaction experience based on investor’s personalized interest aka clean energy.

Impact

Due to a lack of mobile dev resources, we had to delay certain features like the robo advisor capability which led me to redesign the experience.

Beta release of mobile app search feature resulted in increased millennial engagement by 3.3%.

Noticed increased interest in hard cider, gaming companies, electric vehicles, and cannabis stocks.

Conclusion

The creation of a separate product for millennials enhances engagement without disrupting existing customers.

Simplified guidance for stock selection streamlines the investment process and makes it more accessible.

User feedback highlights the importance of catering to diverse user needs and preferences.

Affordability, and transparency, with the aid of a friendly and forgiving experience, are key factors in driving user adoption and boosting confidence for first-time investors.